Australian insights

Treasury consulting on sustainable investment product labelling(Opens in a new tab/window)

Australia's Treasury is consulting(Opens in a new tab/window) on a proposed system to label sustainable financial products. In the Sustainable Finance Roadmap, the Australian Government committed to developing consistent labels and disclosure requirements for investment products marketed as ‘sustainable’ or similar. Sustainable financial product labels seek to help investors identify, compare, and make informed decisions about sustainable financial products. Feedback from stakeholders on scope, disclosures, thresholds and evidentiary assessment, together with further planned consultation with industry and investors, will help inform the policy and enforcement design, ahead of the government finalising its policy position. Submissions close on 13 March 2026

Landscape optimisation is unlocking value for institutional investors(Opens in a new tab/window)

New Agriculture, a platform for large-scale sustainable agricultural investment and operations management, has published(Opens in a new tab/window) a case study on Benditi, a beef producer, which is reimagining its 8,400-hectare property not just as a cattle operation, but as a multi-layered asset where agriculture, forestry, carbon and biodiversity intersect to create diversified value.

Benditi’s landscape will be managed as an integrated whole, with each hectare allocated to its most valuable and sustainable use. Prime grazing paddocks will remain dedicated to beef production, while less productive or previously afforested zones may be repurposed for reforestation and conservation, potentially generating carbon credits and enhancing ecosystem health. Benditi’s template demonstrates how landscape optimisation has the potential to transform agricultural assets into climate-positive, future-ready investments.

Next tranche of environment protection reforms in effect(Opens in a new tab/window)

The Minister for the Environment and Water, Senator the Hon Murray Watt, has announced(Opens in a new tab/window) the next tranche of national environmental laws reforms has come into effect from 20 February 2026. The new provisions include changes to strategic assessments, allowance for conditions to be applied to National Interest Exemptions and new information sharing arrangements. The Minister also acknowledged the receipt of approximately 750 submissions from the recent public consultations around the Matters of National Environmental Significance and Environmental Offsets Standards. Submissions will be taken into consideration for the next phase of drafting.

The Australian Government has started the search(Opens in a new tab/window) for the inaugural head of Australia’s first National Environmental Protection Agency. The new Chief Executive Officer will be integral to administering and enforcing the suite of legislation that protects and manages Australia’s nationally and internationally important plants, animals, habitats and places.

Nature on the balance sheet: Accountability for Nature Positive(Opens in a new tab/window)

An Australian authored paper published(Opens in a new tab/window) in the British Ecological Society’s Methods in Ecology and Evolution journal provides a foundation for mainstreaming natural capital accounting (NCA) as a tool for ecological accountability. NCA provides a systematic approach to the monitoring, assessment, and disclosure of business interactions with nature. Farm-scale NCA has been used to provide decision-useful insights into the natural capital underpinning farm enterprises in Australia.

This paper provides a novel approach to the application of double-entry financial accounting principles to ecological assets, liabilities and equity, offering a structured method for tracking organisational stewardship of nature. It proposes a set of structured statements—Natural Capital Balance Sheets, Natural Capital Income Statements, and Ecosystem Change Statements—that report on stocks of natural capital and associated ecosystem service flows.

Further research is needed to operationalise the framework, refine ecological metrics and integrate NCA into governance and reporting systems.

Forico publishes fifth natural capital report(Opens in a new tab/window)

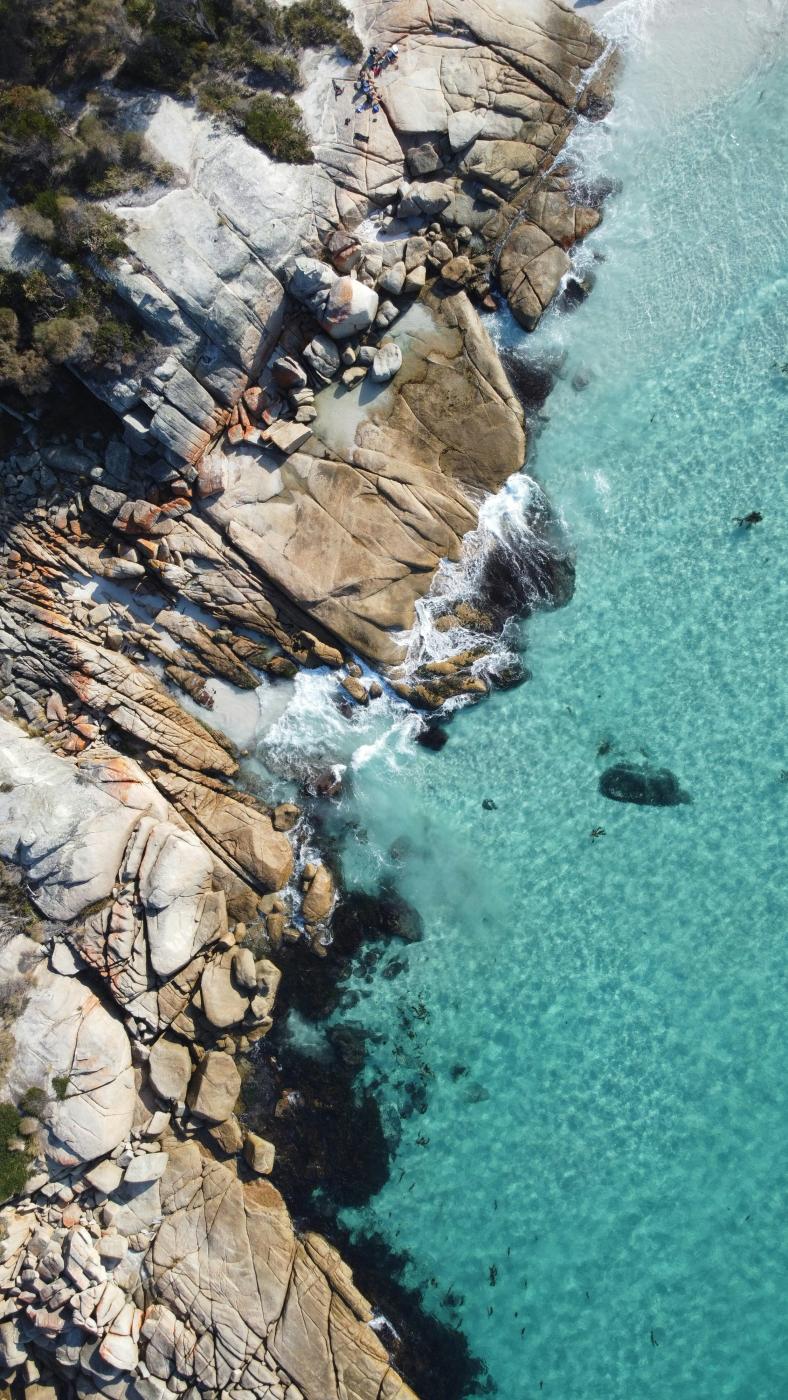

Forico, Tasmania’s largest private land manager, has published(Opens in a new tab/window) the fifth edition of its Natural Capital Report, which places a dollar value on the ecological assets under its custodianship. Forico says that a driver of its natural capital report is its commitment to understanding the value of the lands it manages and its impacts on the natural world.

ACCU Scheme: 2023–2025 progress report(Opens in a new tab/window)

The Department of Climate Change, Energy, the Environment and Water has released(Opens in a new tab/window) a progress report on the implementation of review recommendations to the Australian Carbon Credit Unit (ACCU) Scheme. Maintaining the integrity of the ACCU Scheme and increasing emissions reduction opportunities are important. The government is also committed to continuously improving the scheme, including ongoing work to support innovation in method development, embed cultural and economic benefits for First Nations people in the scheme, and to promote non-carbon benefits of scheme projects, alongside the Nature Repair Market.

Driving innovation and productivity for Australia’s grape and wine sector(Opens in a new tab/window)

Wine Australia has created(Opens in a new tab/window) a new funding pathway, designing the Australian Wine Future Fund, to increase funding opportunities, create additional value, accelerate investments and deliver impactful solutions through two complementary streams: a research and innovation fund, and venture investments portfolio. Environmental sustainability, profitability and competitiveness have been a focus of the research and innovation fund.

International insights

Discussion paper: Sectoral Nature-Positive Transition Pathways(Opens in a new tab/window)

The Finance for Biodiversity Foundation has published(Opens in a new tab/window) a discussion paper on Sectoral Nature-Positive Transition Pathways. The paper, which was co-authored with Business for Nature, the Green Finance Institute, The Nature Conservancy, and WWF, outlines sector-specific plans developed with businesses and stakeholders to identify impacts on nature, set transition milestones, and align economic activity with national biodiversity targets. Noting the synergies between actions to address climate and nature-related risk, it suggests countries which have already developed net zero pathways, such as the UK, Chile, Australia and Indonesia, should integrate NPPs with these existing pathways to facilitate a coherent approach. It argues that NPPs can serve as a roadmap to signal clear expectations and incentives, while helping build the enabling conditions for private investment. Have your say on the discussion paper by 30 April 2026.

Introducing 'The Little Book of Nature Business(Opens in a new tab/window)'

Global Canopy has released(Opens in a new tab/window) The Little Book of Nature Business, which offers investors, lenders, businesses and policymakers a simple inspirational guide to investing in the transition towards a nature-positive economy. It includes more than 80 case studies offering practical examples of investment opportunities in action and illustrates how businesses are innovating and adopting practices that sustainably manage their dependencies and reduce harmful impacts on nature, increase positive impacts on nature, and can contribute to the transition.

ISSB’s Biodiversity, Ecosystems and Ecosystem Services project(Opens in a new tab/window)

The International Sustainability Standards Board (ISSB) has published(Opens in a new tab/window) two staff papers regarding the Biodiversity, Ecosystems and Ecosystem Services (BEES) project ahead of its meeting on 25 February 2026. The first paper relates to essential terms and concepts for standard setting on nature. It recommends the ISSB should define nature-related risks and opportunities, nature-related physical risks, nature-related transition risks, ecosystem services, and the concept of environmental asset. It also recommends changing the name of the BEES project to ‘Nature-related Disclosures’ project. The second paper analyses climate and nature connections. It recommends that the ISSB provide additional guidance on connections, trade-offs and co-benefits between climate and nature-related risks and opportunities, and the effects of connections on entities’ strategy and risk management.

Decoding biodiversity impacts(Opens in a new tab/window)

The Global Reporting Initiative (GRI) has published(Opens in a new tab/window) a practical guide to corporate reporting on biodiversity with the GRI standards. GRI’s publication brings together the experiences and lessons learned from four of the leading organisations – CDL, Coca-Cola HBC, Enel and JSW Steel – that took part in the GRI Community Biodiversity Pilot in 2024-2025, gaining first-hand experience on reporting with the new GRI 101: Biodiversity 2024 Standard. As of January 2026, GRI 101, which contains disclosures for organisations to report information about their biodiversity-related impacts, is in effect for all GRI reporting. Interoperability is essential, that is why GRI’s biodiversity standard aligns with leading frameworks, including the Taskforce on Nature-related Financial Disclosures.

Applications open for companies to pilot expanded freshwater targets(Opens in a new tab/window)

The Science Based Targets Network (SBTN), with the Accountability Accelerator, are launching(Opens in a new tab/window) a pilot for companies to set and validate expanded freshwater targets to include groundwater and pesticides. SBTN is seeking companies to pilot the Version 2 guidance and help further refine the methods and validation process to ensure targets are credible, practical, and ready to scale.

Applications are open until 10 March 2026. The pilot will run from June to September 2026. Up to six companies will participate, with additional companies able to join as observers to learn from the process in a lower‑commitment setting.

EY’s sustainable operating blueprint(Opens in a new tab/window)

EY has published(Opens in a new tab/window) its sustainable operating blueprint, a holistic framework to support organisations building roadmaps to turn sustainability ambition into clear practical steps. EY’s blueprint is built on two pillars – strategic clarity and operational embeddedness. It uses 9 key levers and 33 sub-levers to guide businesses in defining and embedding sustainability across the entire organisation.

Businesses face significant risks from the destruction of nature(Opens in a new tab/window)

Zero Carbon Analytics, an international research group, has published(Opens in a new tab/window) insights on the risks to businesses from nature loss. The insights note that according to Barclay Bank profits in the mining and power generation sectors could fall by 25% in the next five years due to nature degradation. It also draws on research from the European Corporate Governance Institute’s working paper, which found that water and climate dependencies dominate corporate nature risk. This study highlights linkages between greater dependency and greater impact on biodiversity, resulting in a double materiality of nature loss. Zero Carbon Analytics concludes that investing in and protection in nature is essential to keep businesses, and society, functioning.

Bill paves way for MCERT(Opens in a new tab/window)

The New Zealand Government, Te Kāwanatanga o Aotearoa, has introduced(Opens in a new tab/window) legislation to Parliament to establish the new Ministry for Cities, Environment, Regions and Transport (MCERT), a key step in delivering its ambitious reform agenda across housing, transport, urban development and the environment. MCERT will administer the Environment Act. MCERT is set to be established from 1 April 2026 and become operational from 1 July 2026.